Own your money

Non-custodial Bitcoin-backed lending providing institutional-grade liquidity

Bitcoin-backed lending platform

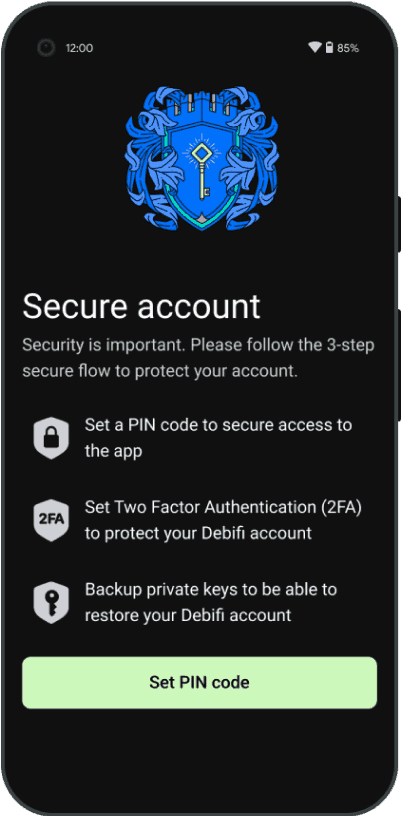

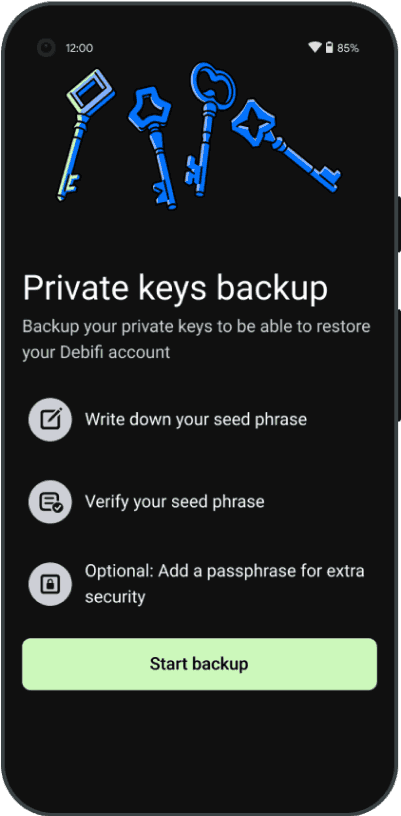

High security

Debifi uses a security protocol where all actions must be signed with a private key generated on a separate device app.

Your keys, your coins

Debifi does not store your collateral; it offers a 3 out of 4 multisig solution with keys distributed among trusted parties.

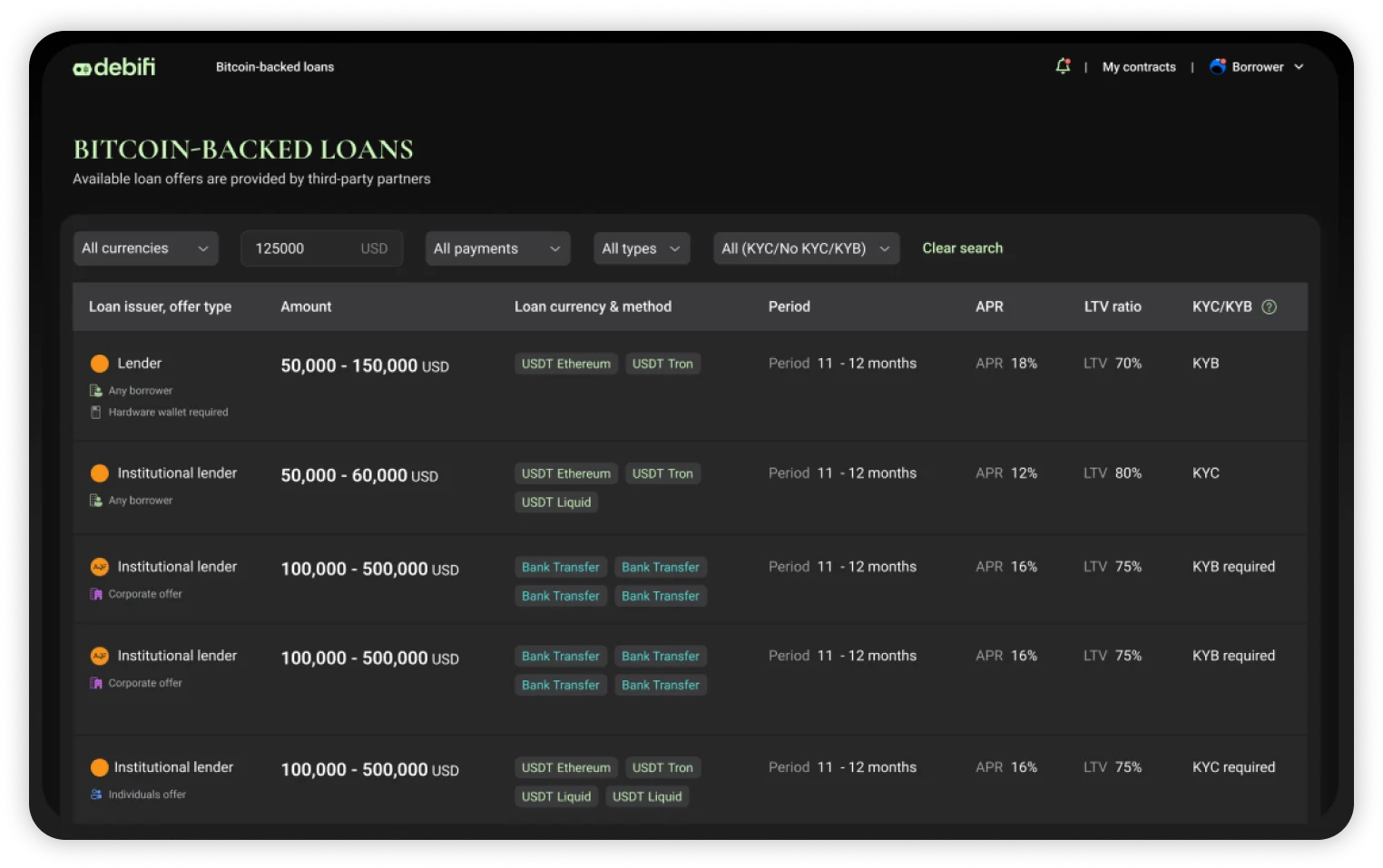

High volume loans

Debifi connects you with independent institutional-grade liquidity providers, offering loans for up to 5 years period.

made by bitcoiners

By borrowing on Debifi, you stay in control of your Bitcoin, with a multisig escrow system in place, you avoid collateral rehypothecation and have the highest level of transparency and security.

Explore the full potential of your Bitcoin with borderless stablecoin and fiat loans!

How does Debifi work?

Loans issued by institutional lenders. Everyone can become a borrower.

Escrow creation

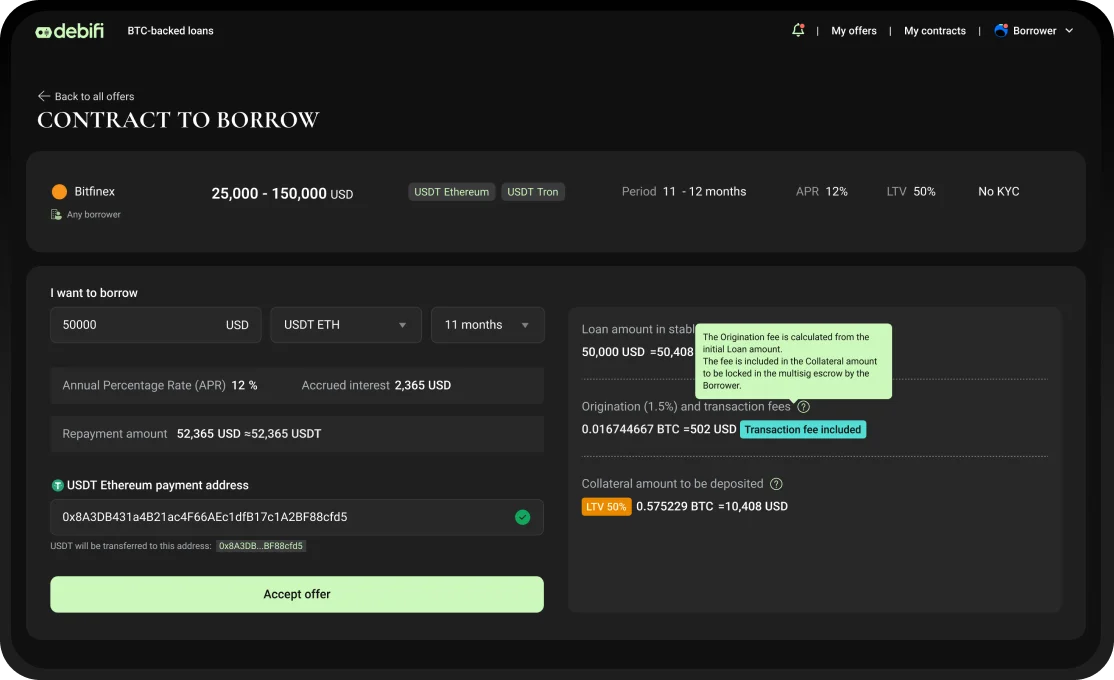

At Debifi, taking out a loan doesn't mean losing touch with your Bitcoin. Our multisig escrow system ensures your collateral is dedicated to securing your loan.

Loan origination

With Debifi, the security of your Bitcoin-backed loan is the main priority. Initiate your loan contracts safely and efficiently through the Debifi App.

Loan repayment

Repaying your loan is straightforward and secure. The borrower sends the loan amount plus interest directly to the lender's wallet.

Become a Bitcoin-backed lender

Earn attractive margins by lending stablecoins and fiat globally, secured by Bitcoin. Avoid risk with over-collateralized loans, 3 margin call system, automatic liquidations, and high-security protocol.

On Debifi, your money is backed by one of the safest assets - Bitcoin. Lend on Debifi and have full transparency and control over the collateral asset, ensured by a multisig escrow system.

Explore the full potential of Bitcoin-backed loans!

Flexible conditions and best rates

Debifi acts as a global lenders aggregator.

Any financial institution in the world can become a lender and compete with others in the free market.

No rehypothecation of your funds

Debifi creates a unique multisignature address on Bitcoin's blockchain for each lending contract, and your collateral is stored there until the loan is repaid.

Featured ON

Testimonials

Lenders and borrowers are voicing strong support for Debifi. Their testimonials point to quick payouts, fair terms, and a smooth, reliable way to unlock Bitcoin’s value.

Debifi Bitcoin-Backed Loans:

A Competitor Comparison

Debifi is built by Bitcoiners, for Bitcoiners. The team brings over seven years of experience working exclusively on other Bitcoin-only projects. Debifi aims to lead the Bitcoin loan space, and comparing its features to those of competitors highlights its distinct advantages.

| Feature | Typical Competitors | |

|---|---|---|

| Custody | Pure multisig escrow | Often custodial/mixed |

| Loan Flexibility | Short-to-long term, flexible | Usually fixed-term options |

| Bitcoin-native philosophy | Fully Bitcoin-focused | Multi-coin, less specialized |

| Rehypothecation | Strictly none | Usually none, but not always transparent |

| Minimum loan amount | Flexible loans, no minimum | Often high minimums for institutions |

The Growing Popularity of Bitcoin Loans in 2025

The Tax Impact of Digital Assets When Compared to Standard Asset Sales

Don’t sell your assets

Selling an asset like Bitcoin results in capital gains taxes, which can significantly reduce the net proceeds from the transaction, as you must pay the amount due from the principal profit.

Instead of selling, many Bitcoin holders are choosing to take out cash loans backed by their Bitcoin holdings. This strategy allows investors to avoid triggering a taxable event while maintaining long-term exposure to Bitcoin’s potential upside. It is a method widely recognized among seasoned investors for its role in capital preservation and strategic tax mitigation, underscoring Bitcoin’s unique strength as high-quality collateral.

Borrow against them

By leveraging Bitcoin-backed loans, investors can navigate economic uncertainty and persistent inflation with greater flexibility. These loans are becoming an increasingly attractive tool for experienced Bitcoin holders seeking financial stability, liquidity, and improved outcomes in a challenging macroeconomic environment. By spending borrowed funds rather than the bitcoin themselves, you gain access to funds to cover expenses or other needs without compromising your investment strategy.

Borrowing Against Bitcoin vs. Selling: Liquidity Without Losing Digital Assets

Understanding the key differences between selling your Bitcoin and using it as loan collateral is essential.

The idea of loans taken against assets is not new, such transactions are common in many investment vehicles, notably property and precious metal markets.

The ability to retain control of your Bitcoin and access funds to cover any expenses you may have is invaluable.

| Features | Bitcoin Backed Loans | Selling BTC |

|---|---|---|

| Keep long-term BTC exposure | Yes, you keep your Bitcoin | No, you lose Bitcoin exposure |

| Immediate liquidity | Yes | Yes |

| Avoid potential capital gains taxes | Yes, typically no tax event | No, usually triggers taxes |

| Retain BTC’s upside potential | Yes | No |

| Protection from forced selling at low prices | Yes, your assets are safeguarded from selling at market lows | No, exposed to the risk of selling at unfavorable prices |

Can you use these loans without selling your Bitcoin?

As with any product, Bitcoin-collateralized loans appeal to a broad range of borrowers. Each holder of Bitcoin has distinct advantages that are tailored to their specific financial goals.

Here’s a breakdown of some common borrower types:

Clear Terms and Customizable Features

Transparent and custom-tailored loan terms continue to boost the appeal of Bitcoin-collateralized loans. Borrowers have the flexibility to adjust loan parameters to match their individual risk tolerance and financial situation.

Essential features include:

Loan-to-Value (LTV) Ratios

LTV determines how much liquidity you can borrow against your Bitcoin collateral. Typical ranges across the Bitcoin lending industry include:

Conservative (20%–40% LTV):

Low-risk borrowing is ideal for maximizing security against Bitcoin’s price volatility.

Balanced Approach (50% LTV):

A widely accepted option that offers substantial liquidity while maintaining a protective collateral buffer.

Aggressive (70%–85% LTV):

Allows for increased liquidity but comes with a higher risk of liquidation during market downturns. This strategy requires active monitoring of Bitcoin market conditions.

Interest Rates

Rates typically depend on your chosen loan-to-value (LTV) ratio, current market conditions, and the length of the loan term:

Loan Purpose

To meet consumer or business credit needs

Fixed Interest Rates

Defined rates remain constant for the duration of the loan and typically range from about 9%-18% APR depending on the LTV selected.

Loan Duration and Flexibility of Loan Repayment for Any Loan Amount

Repayment schedules for loans are often flexible and tailored to the user's needs:

Options for Term Length

Rates typically depend on the selected loan-to-value (LTV) ratio, prevailing market conditions, and the duration of the loan term.

Open-Ended Loan Terms

Bitcoin-only payment structure with flexible timelines: Payments can be made at any time as long as the minimum collateral requirements are met.

Payment Schedule

Bitcoin loan payments are typically interest-only throughout the term, with the principal due at loan maturity. Most lenders allow for early repayment of the principal without penalty or fees.

Liquidation Rights (Margin Calls)

As the price of bitcoin is volatile, responsible lending includes specific margin call policies within the agreement:

Margin Call Policy

Set margin call policies (usually 70%-80% LTV but can change, this is for illustrative purposes only) and notify the borrower to either pledge additional collateral or pay down some of the loan.

Transparent Terms for Automatic Liquidation

Activation of certain preset terms to protect borrowers due to unanticipated risk if the value of the collateral drops sharply.

FAQ

What is a traditional loan?

A traditional loan is a form of financing provided by a bank or financial institution, typically requiring a credit check, income verification, and collateral such as property or assets. The approval process is often lengthy and regulated.

What is a crypto-backed loan?

A crypto-backed loan allows borrowers to use cryptocurrency - such as Bitcoin - as collateral to receive fiat or stablecoin liquidity. The borrower retains ownership of the crypto, which is returned once the loan is repaid in full. With competitive interest rates and zero fees, they are economical and practical solutions for maintaining liquidity without selling your Bitcoin.

How do crypto-backed loans differ from traditional loans?

Crypto-backed loans do not require credit checks or income verification. Loan approval is based solely on the value of the crypto collateral.

What does loan-to-value (LTV) mean in crypto lending?

LTV is the ratio between the loan amount and the value of the cryptocurrency collateral. For example, a 50% LTV means borrowing $50 for every $100 worth of Bitcoin held as collateral. Lower LTVs reduce liquidation risk, while higher LTVs offer greater borrowing capacity with more risk.

What are commercial loans?

Commercial loans are financing products provided to businesses rather than individuals. They are used to fund operations, real estate purchases, equipment, or expansion and may be secured or unsecured based on creditworthiness and collateral.

What affects interest rates in crypto-backed lending?

Interest rates are influenced by the loan-to-value ratio, loan duration, collateral volatility, and platform-specific risk assessments.

Got more questions?

Answers to all your questions on our FAQ page